If you are in the financial sector, you may have heard about the evolving field of Real Estate Investment Trusts (REITs). It is a progressively growing segment in the American financial sector as it produces income-oriented real estate.

However, is Real Estate Investment Trusts a good career path?

Since 1960, REITs have been a great career choice based on their substantial growth. Regardless of your initial career, choosing it will enhance your portfolio diversity. You can find various job opportunities in this real estate career. Besides, $1.25 trillion was the market capitalization in the United States for REITs, making it a promising career path.

Did you know that the main opportunities for REITs would be in a managerial position? Eventually, you can create a significant impact in the commercial sector of real estate.

If you would like to know about Real Estate Investment Trusts in detail, read this article till the end.

What are Real Estate Investment Trusts (REITs)?

Source: InvestorJunkie

Ideally, a Real Estate Investment Trust is a company or an agency. Such organizations own or operate various income-producing real estate units.

As a REITs agent, you will either be working for a company or be the head of such a company.

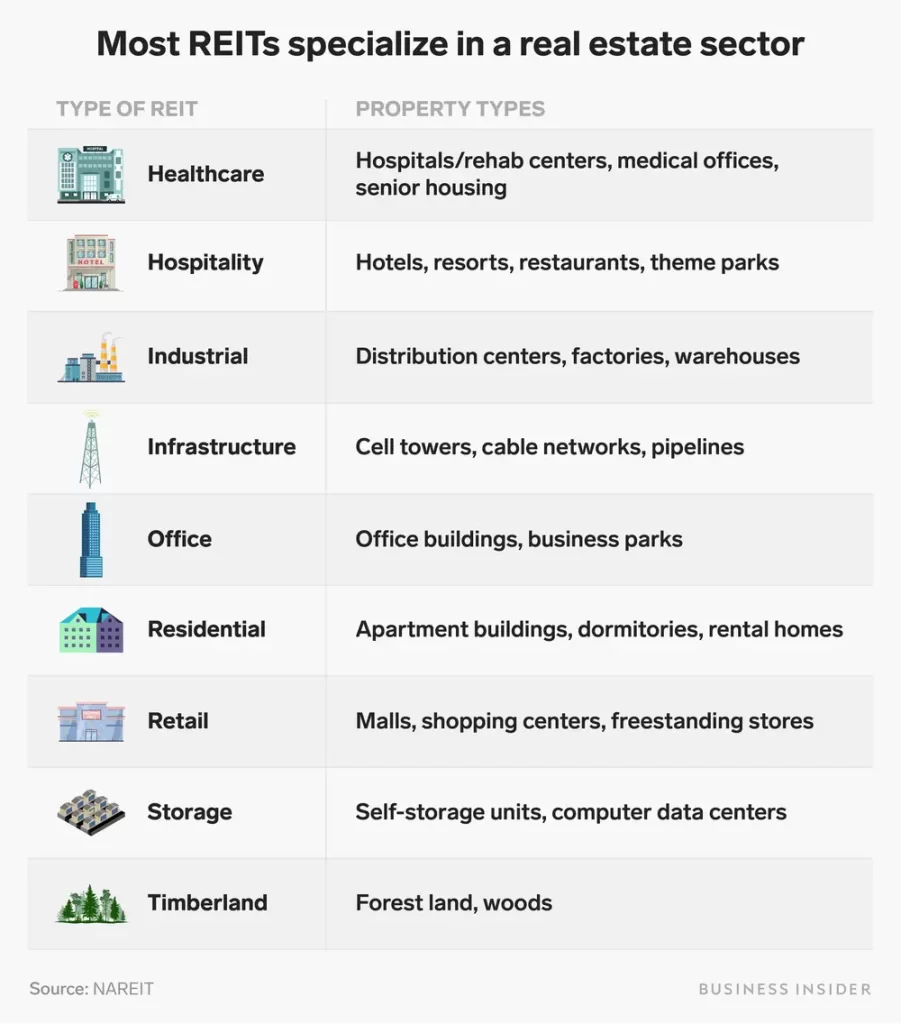

Your firm may own various commercial properties, including real estate for offices and warehouses. Besides, REITs can own shopping centers, apartment buildings, and even hospitals. Some REIT agencies also engage in the financial sector of real estate. Initially, Congress created them in 1960 to give everyone opportunities to benefit from real estate investment.

As an agent, you can help investors own valuable real estate property as stocks. Therefore, you must have real estate and finance knowledge to be a part of this growing industry. Not only does REIT present itself as the best-returning process, but also as an incentive-oriented career choice.

Fun Fact: Investors could gain dividend-driven ROIs to help communities thrive, grow and revitalize.

What are the Types of Real Estate Investment Trusts?

According to an SEC report, a REIT must pay 90% of its taxable income in the form of shareholder dividends.

These companies follow regulations presented by the United States Securities and Exchange Commission. Therefore, they must meet specific criteria to operate in the industry.

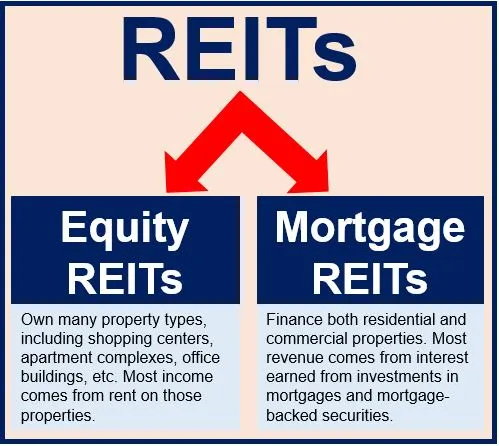

Ideally, REITs buy, own, and sell commercial properties and let people invest in the different types of real estate directly. Would you like to know the varying forms of REITs that operate? You can find these common ones in the United States:

-

Equity REITs –

These companies own and manage properties themselves or subcontract them to other firms. Besides, they pay at least 100% of the dividends to the shareholders.

-

Mortgage REITs –

Such organizations manage and purchase mortgages from commercial properties. In addition, this REIT will distribute 90% of the income to its shareholders.

-

Hybrid REITs –

These REITs would manage properties and outsource the financing bit through preferred equity and debt.

In the United States, REITs have mostly incorporated the hybrid form of investment. Moreover, most of them focus on real estate properties that produce income for the investors. You might work for companies that hold onto properties for long-term financial gains.

Also Read: How Blockchain Technology Has Revolutionized the Real Estate Sector?

Is Real Estate Investment Trusts a Good Career Choice for You?

Source: ShellyRobersonRealtor

So, if you ask a question about whether real estate investment trusts is a good career path, then I would say that Yes, Real Estate Investment Trusts is a good career option for you, only if you are passionate about finance and real estate.

As a REITs agent, you have the power to offer investors the chance to own and gain ROI from valuable real estate. Besides, you can present opportunities for various dividend-based income to amateur investors. This way, as an agent, you would have the chance to help communities grow.

The publicly-traded company you work for would give you ample opportunities to diversify your career. In turn, increasing your potential talent and enhances your recruitment openings.

The United States has several universities offering related courses for the REITs industry. You can get a degree from such colleges and look for job opportunities in real estate. Some of these courses and programs include:

- Accounting for real estate

- Design of commercial buildings

- Property management

These courses could help you enter the industry smoothly. However, you would require work experience in real estate, apart from internships. Therefore, you can even aim to get a bachelor’s degree in fields like:

- Accounting

- Real estate

- Statistics

- Finance

What to Expect in a REITs Career Path?

The main roadmap to the REITs career will take you on a financial journey. Besides, the pathway would lead you to obtain a position in the headquarters.

As a certified agent, you will be responsible for overseeing operations and locating value-based properties. You could even opt for another entry-level job in REITs.

Some companies work for independent brokers. If you work for such companies, you will represent their properties and perform screening for potential tenants. Therefore, you can expect leasing agent, property manager, and client representative jobs.

In the United States, certifications are a great way to enter the Real Estate Investment Trusts profession. You will require a license to sell real estate as a company or a broker. Besides, you or your company must be a Certified Commercial Investment Member accredited by the CCIM Institute.

Fun Fact: Being an appraiser or an investment banker could also land you on this career path.

Jobs Available in REITs – Look for Your Employment Opportunities

Source: Reit

Once you have been well versed with the intricacies of the REITs industry, you are already halfway towards a new career. It is crucial to understand what this opportunity brings. Only then can you find a definitive answer to the eternal question – Is Real Estate Investment Trusts a good career path!

That being said, it would be a good idea to know what types of employment opportunities this career presents to you. The top-paying job prospects in the United States REITs industry are listed below.

1. Property Managers

Estimated Salary: $45,000 to $59,000 per year

You will work as a third-party property manager for a REIT organization. Such managers need to act on behalf of their company to find new real estate properties. From here, you could hone your skills and lead yourself to senior management positions.

2. Development Executives

Estimated Salary: $100,000 per year

The question “is Real Estate Investment Trusts a good career path?” comes full circle with this chief executive position. As a development executive, you would have a tremendous impact on your company. This operational position does require a deep knowledge of the market and finance. It is because you are responsible for identifying new developing budgets and properties.

3. Asset Managers

Estimated Salary: $49,000+ per year with five years of experience

This mid-level management position includes decision-making capabilities. As an asset manager, you need to decide which properties your clients should purchase. At the same time, you might also have to offer a financial deal to them. In short, this role would ask you to oversee the property operations and determine the expenses compared to revenue projections.

4. Acquirement/Acquisition Analysts

Estimated Salary: $52,000 to $69,000 per year

As an acquisition analyst, you will be responsible for coordinating, implementing, planning, and identifying potential real estate properties to acquire. Consequently, you should have a good knowledge of the market trends to help you identify acquisition targets. Moreover, you need to negotiate the price, prepare agreements and guide the client through the process.

Skills You Need to Develop for the REITs Industry

Despite being a good career path, the REITs industry is not for everyone. You should harbor a few essential skills to scale up in these companies. Some of the skills required include:

- Real estate knowledge

- Understanding of financial statements

- Ability to market research

- Property and asset management

- Due diligence toward real estate and finance

- Better information on financial models

Along with these, you should have soft skills for communication that will help bring enough ROI for your organization. You must have intricate knowledge about the market conditions as well.

So, is Real Estate Investment Trusts a viable career choice? Indeed, the United States is trying hard to put this career option in the limelight, creating numerous statistical data. All of these allude to the effectiveness of this career path.

Also Read: 3 Technologies Disrupting Real Estate Today

Requirements for a REITs in the United States

Source: Insider

People are investing real money to acquire the ownership of particular profit-worthy real estate properties. It is a great avenue to start your own real estate business geared towards investment trusts.

Doing so would require you to abide by specific regulations before offering the investment opportunities for your REITs company.

- A REIT must have a board of directors and trustees experienced in managing everything

- 90% of the REIT’s total taxable amount needs to go back to the investors

- About 75% of your company’s income should come from real estate investment

- At least 75% of the monetary funds from your treasuries must be eventually invested in real estate

- A REIT should have at least 100 investors or shareholders which equal ownership

Even then, you can choose to venture into this avenue due to the diversification, liquidity, transparency, dividends, and high performance.

Frequently Asked Questions

1. Why work for REIT?

Ans: Various REITs work for or with a third-party property management company. Such managers would act on behalf of the REITs company to scour for new real estate properties. So, yes, you can work closely with a REIT in the senior management position which oversees multiple locations. Therefore, it is the top career path in the real estate industry.

2. How much can you earn working for REIT?

Ans: As a property manager, you can earn anywhere between $45,000 to $59,000. Besides, as an experienced development executive, you can earn $100,000. Asset managers in REITs can earn over $49,000, whereas acquisition analysts earn $69,000. So, you have the chance to earn between $45,000 to $100,000 every year.

3. What are the skill sets required to become a REIT agent?

Ans: To become a part of the Real Estate Investment Trust community, you should possess immense financial skills. In addition, you must be proficient in written and verbal communication with good technical skills. You must be suitable as a data analyst. Moreover, a bachelor’s degree in finance, statistics, real estate, or accounting is necessary.

4. Is Real Estate Investment Trusts a good career path?

Ans: REITs as a career requires intense drive and passion for finance and real estate. This way, you could gain good ROI from this profession. It is a great career option if you have a keen interest in finance and real estate. You will get exposure to diversification that could help you with your resume.

5. What are the advantages of REITs?

Ans: Working for a REIT can become beneficial in multiple ways. Most importantly, REITs are transparent and offer enough liquidity options for everyone. It would diversify your career and give you access to the actual performance capacity of the real estate industry.

The Bottom Line

Is Real Estate Investment Trusts a Good Career Path? Real Estate Investment Trusts is indeed a good career path. It is an excellent profession if you have a keen interest in finance and real estate.

Consider getting a degree in corporate finance before applying for courses like accounting in real estate. This way, you would have the basic market knowledge before entering this field.

You must understand what Real Estate Investment Trusts stand for. Only then can you generate the passion and grit required to excel and explore this career.

Once you have decided, you will find numerous job opportunities in the United States. According to GoBankingRates, this industry has over 1,000 job openings in various entry-level, mid-level and managerial positions.

You can expect a good salary, between $45,000 to $100,000, based on your experiences. So, are you ready to venture into the world of REITs?

Also Read: ProTech Trends That Will Soar High in 2022

Gracie Johnson is a Senior Content Writer at MyTechMag. She is an enthusiastic learner and loves to explore all the areas of technology.