You might be aware that lead generation is the most critical step of marketing. Usually, companies have a target demographic in mind before devising campaigns and tailoring them accordingly.

But what happens if a vast market with significant revenue remains largely untapped?

For banks, this market is commercial businesses. Most marketing campaigns are geared towards consumers, leaving a lot to be desired on the commercial side. Since B2B and B2C expectations differ, marketing must adapt and fulfill these requirements.

The commercial banking market occupies the lion’s share of the market, standing at a valuation of $2540.3 billion in 2021. The revenue promises to grow significantly and reach a value of $7404.4 billion by 2031. Despite the absence of major B2B bank marketing trends, the industry sits at a dominating position in the market.

Targeting commercial organizations through accurate marketing campaigns will only add to this revenue. But how can banks do it? Let’s look at some B2B marketing strategies for banks that can help.

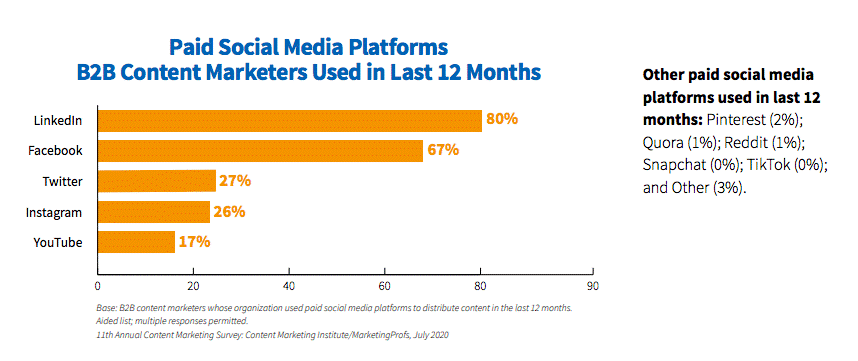

1). Leverage Social Media to Reach Prospective Customers

Social media can help amplify marketing campaigns, irrespective of your target. Hence, it is a robust tool in both B2B and B2C marketing. Similar to how an average consumer browses through Facebook or Instagram, so do business owners.

Not to mention, the competition for Google Ads is comparatively lesser for banks targeting commercial organizations.

Combined with the marketing department, the social media team can devise an effective strategy to lure in small and medium business owners. B2B bank marketing campaigns also require some basic goals like:

- Familiarizing the business with the bank and its services

- Building trust and credibility

Increasing sales and revenue is essential as well. However, if the business is aware of your brand and knows the channels to reach you, that’s the mark of a successful campaign.

2). Promote Treasury Management Services

Business finances can be tricky to handle. Most organizations outsource the handling of their financials to an accounting firm that streamlines the process for them. Although the trends concluded that only 30% of small business owners are likely to hire an external accountant, the figure is higher for big organizations.

At a time like this, treasury management services can be invaluable. A management system that optimizes the business’ liquidity and reduces risks can help small and medium-sized organizations immensely.

One of the major advantages of promoting these services is that they offer a centralized approach for businesses to handle their finances. Unlike outsourcing, treasury management services allow organizations to improve banking relationships and are safer in the long run.

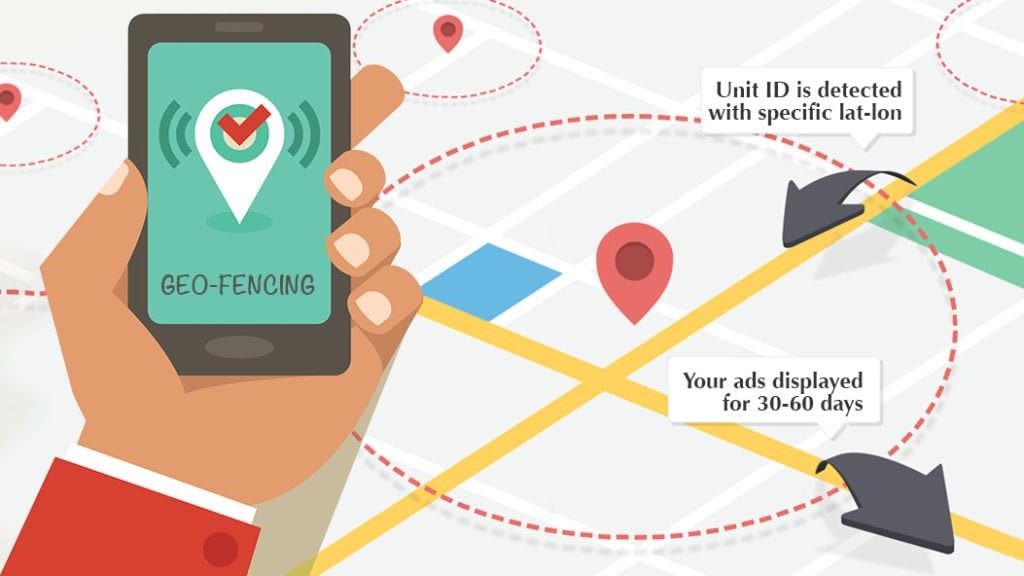

3). Geo-Fencing can help Target Specific Groups

The concept of geo-fencing is straightforward. You can use location-based services to trigger a particular marketing action. The action could include one of the following:

- Push notification

- Social media advertisement

- Text

These services usually rely on radio frequency identification (RFID) technology found in various applications and software. When the customer enters a particular virtual boundary, known as a geofence, one can send targeted marketing messages relevant to the area or activity.

The concept can be better understood with an example. Suppose there is an important conference in town, which several corporate attorneys are expected to attend. You can use geo-fencing to help familiarize them with your bank and its services.

Geo-fencing will allow you to target every member within the conference area.

4). Rely on Data-Driven Insights to Drive Marketing Campaigns

The value of accurate data cannot be undermined, at least in the current technological landscape. Organizations are vying for genuine data and hoping to leverage it for increased conversions and ROIs.

A whopping 42% of B2B marketers are aiming to invest more in case studies and public surveys. The reasons for the popularity of these tools are:

- Cost-effective marketing tool that relies on volunteered and genuine information

- Builds brand identity and authenticity

- Gathers data of B2B companies and their decision-makers

- Provides an insight into the customer’s needs and wants

Data-driven decisions can contribute to the formation of some of the best B2B bank marketing campaigns. They are also helpful in reducing costs and time, and you can target businesses that can use your services.

5). Form a Dedicated Marketing Team to Attract Commercial Businesses

Banks and financial institutions often have a dedicated marketing team to appeal to B2C customers. But what about the commercial businesses looking to expand? Clearly, they could contribute immensely to your bank’s profits.

B2B and B2C marketing are different procedures, each with its own goals and strengths. A marketing team dedicated to customer-centric campaigns cannot do justice to your bank’s commercial clients.

A dedicated B2B marketing manager and a responsive team could be what’s missing from your marketing efforts. This team can help onboard new businesses and prove invaluable in retaining B2B customers in the banking industry. In addition, you can also facilitate collaboration between the social media and marketing teams to increase campaign effectiveness.

Organic content can also help, and you can use the input of your other employees to enhance conversions.

6). Drive Initiatives to Make Businesses Feel Valued

Corporate responsibility is a budding concept that has motivated organizations worldwide to leave a positive impact on society. Various banks and financial institutes are involved in this drive, with an aim to:

- Follow sustainable practices

- Leave a positive impression on stakeholders

- Add value to the company

Your bank can use it to target small and medium businesses to make them feel valued and gain their trust in your services. Let us see the example of a company that delivered.

American Express, one of the biggest names in the US, has always been vocal in promoting small businesses. It has made numerous efforts to get people to “shop small.” One such initiative involved rolling out a new campaign in several cities to drive traffic to local businesses.

These campaigns use QR codes and digital out-of-home advertisements to redirect individuals to small and local businesses. It started as a minor campaign to help companies to recover from the 2008 financial crisis.

However, it evolved into one of their most significant undertakings.

Driving initiatives and campaigns addressing particular issues can help you reach out to small and medium businesses. Business owners are also more likely to trust your bank if you assist them with your projects.

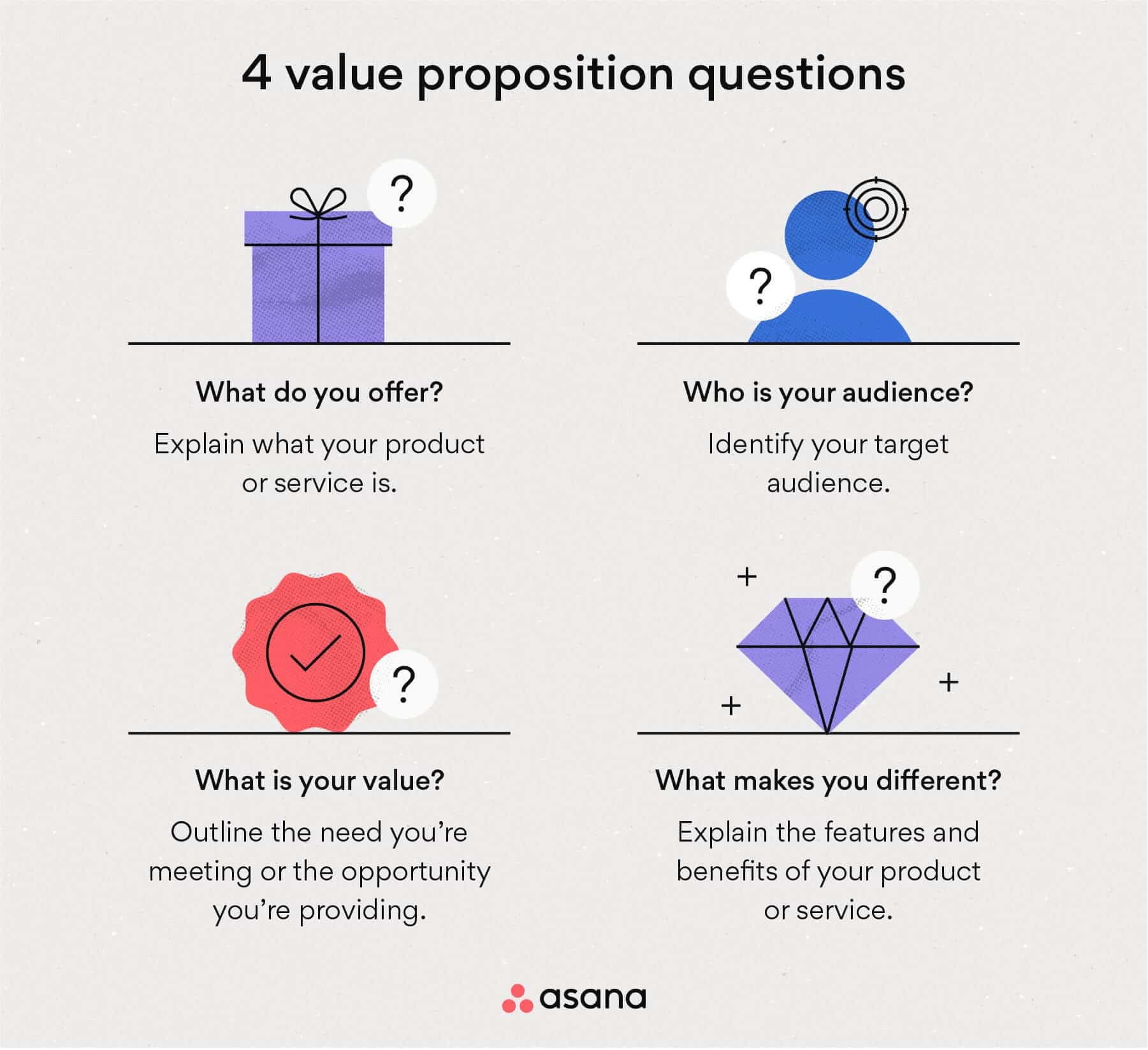

7). The Concept of Value Proposition

Numerous banks in the ever-increasing market offer a host of services. Businesses might ask: What makes your bank so unique?

This is where a value proposition comes into play. It highlights your institution’s strengths to assure potential businesses. This element is displayed as a simple statement but demands the utmost clarity.

Value propositions are important to your marketing campaigns since they can convince a business to choose your services. You can incorporate the following elements to prepare a compelling value proposition for your organization:

- A robust, short, but concise headline about the benefits that the company can offer

- Subhead-line immediately after to elaborate on the benefits and highlight the unmatched value of your bank’s services (not more than two to three sentences long)

Most importantly, value propositions need to be unique and catchy. You can choose to add illustrations that might attract readers and explain your message more efficiently.

Good value propositions identify prospective customers and their primary issues. They also offer unique solutions to cater to their problems and help in the formation of effective bank email marketing campaigns.

Summing Up

With immense market competition, ensuring that your campaigns reach prospective businesses could be challenging. However, every market has a niche audience that requires specific services.

Targeting small, medium, and large organizations is crucial for banks to attract new clientele and witness better profits. Often, businesses seek a loan or financial assistance to expand their operations and employ more people. In turn, the bank can capitalize on it and provide attractive offers to assist them.

Only through a combination of B2B and B2C marketing, financial institutions can go beyond projected marketing figures. The industry is still on the upward trajectory of growth, and commercial organizations can help amplify this growth rate.

So, use the B2B bank marketing ideas to breathe new lives into your marketing campaigns!