Since 2018 have been witnessing two fintech mega trends converging to create a perfect storm within the previously stale world of finance: banks buying fintech companies while fintech challengers create partner networks. In 2019 we are expecting these trends to strengthen, transforming the world of personal and business banking beyond recognition. This post explores the driving forces behind the finance industry transformation and highlights the developments we are already starting to witness.

The Future of Banking Has Quietly Arrived

Fintech startups, forever seeking to disrupt the stalwarts of banking, have been recently gaining more momentum thanks to deregulation. Lower barriers threaten the banking monopolies and stimulate competition, resulting in a financial arms race between startups offering faster, easier and cheaper banking services and the current industry leaders who are investing in new tech in an effort to stay relevant. As a result, customers benefit from a variety of fast and easily accessible possibilities to manage personal and business finance.

To Artem Timoshenko, founder of Genome, global digital payments ecosystem and payments provider, the future of personal and business finance is a win-win-lose proposition, with customers and startups on the winning side, and traditional finance caught in a cycle of decreasing revenues at the time when additional investment in better banking tech is a given. “Today, you can already send money internationally to your relatives in two to three seconds while on your way to work, as well as exchange currencies and rebalance your retirement account, since you already opened the app,” he says. “As a business owner, your abilities to be in the know on how your business is doing and to direct cash flow in real time are far greater than with the old school banks,” Artem added.

Current Fintech Industry Landscape

Life has become easier for financial service consumers, essentially all of us, with companies like PayPal, Revolut, N26, Monzo offering an ever-growing list of financial services. Startups and fintech companies grow their service portfolio by partnering with other service providers, while the old banks take the route of buying promising startups and digital finance companies outright.

While cryptocurrency price volatility put a damper on new cryptocurrency startups, overall fintech investment still surged in 2018, hitting $55 billion worldwide, or double the figure from the year before, Accenture reports. What’s more, fintech innovation is not just happening in the Silicon Valley. Companies are popping up on a global scale, with startups outside of US, UK, and China accounting for 39% of funding, according to Forbes. Fintech hubs emerging globally have attracted funding for 1,463 companies in 2018, boosted by an influx of corporate investors, according to CB Insights.

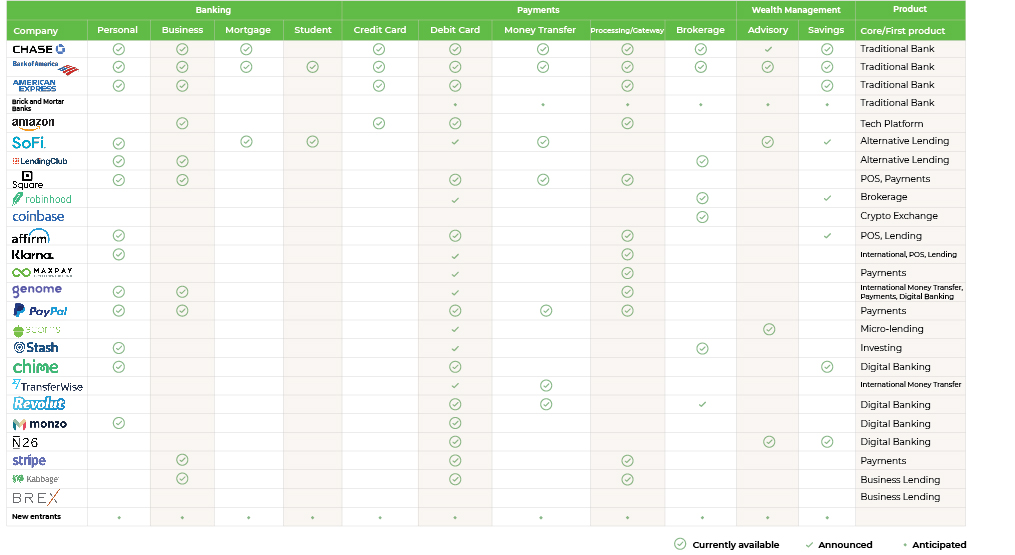

The table below samples brands in terms of financial services coverage.

Above, Personal and Business columns cover tools that manage bills and track

personal and/or credit accounts, as well as marketplace lending and alternative

underwriting platforms. Mortgage and Student cover digitization and financing platforms that enable these important debt categories. Money Transfer covers money services between various personal and business accounts, as well as bill pay and money transfers, including cross-border payments and remittances. Payments include payments processing, card developers and subscription billing software. Brokerage combines stockbrokers and platforms that allow trading traditional and alternative asset classes. Advisory unites investment and wealth management platforms and analytics tools that recommend various asset classes and evaluate them, but do not sell their own financial products. Savingsm includes traditional insured deposits for people and businesses, as well as peer-to-peer lending.

Based on the table it can be argued that it is becoming more difficult to see the advantage of large, established players. As fintech startups grow into unicorns, perfecting the service delivery in each specific vertical, a network combining these services can act as powerful alternatives to established players.

Apps as Banks of Choice

For consumers, significant changes driven by fintech services being accessible from every smartphone mean that the use case for going to physical branches and waiting in lines is becoming unappealing with each day. Consumer-driven financial services, for now, are mostly targeting young professionals, but as these services grow, the existing brick-and-mortar banks will have to rethink their retail strategies of maintaining the customer relationship beyond the safety box service.

Business Follows Online

At the moment, most of the innovation in business banking is targeting small business owners whose tech appetite is influenced by B2C services. These business owners are no longer satisfied with the state of traditional banks, seeing them as fragmented and broken. Fintech companies are already offering the most common services they require, like paying salaries, currency exchange, instant cross-border transfers to bank accounts and wallets, accepting payments, etc. via apps. This elevated customer experience will eventually filter through to corporate banking, as startups continue to muscle in on the services traditionally offered by the big incumbents.

Takeaways

Whether the incumbents, the proverbial old dogs learn the new fintech tricks, or whether the fintech challengers combine to disrupt personal and business finance, banking in the near future will be forever changed. Better customer service (and self-service), B2C approaches filtering into B2B world, intuitive and digital service provision are here not only to stay, but to redefine the industry that long resisted disruption. The future is already visible, and a tidal wave of innovation will very soon change its landscape, leading consumers and businesses better off, saving time and money in the process.

Artem Tymoshenko

Artem Tymoshenko is a fintech sector professional with experience in international acquiring, payment systems, processing systems, e-money, risk management, network and system security, digital self-service, and e-billing. He is a founder of Genome, a payments ecosystem that offers a fast way to open Merchant Accounts as well as personal and business European IBAN bank accounts fully online under 48 hours. Also he is a CEO of Maxpay an international payment service provider.