The capital market solutions sector is presently at crossroads. Rapid change fueled by disruptive technologies like AI, blockchain, and digitization is now necessary. Factors such as compliance, rising costs, and declining revenues all contribute to the difficulties.

Customers today expect a rich diversity of value-added offerings and comprehensive solutions. This necessitates a complete restructuring of fundamental systems, which will provide a strategic edge and long-term viability. Most businesses are increasingly using flexible and experience-centric asset management and capital market solutions globally.

In such a fast-paced environment, capital market solutions providers aspire to offer broker-dealers, asset managers, investment banks, Financial Market Infrastructure providers (FMI), and wealth managers a disruptive competitive advantage.

They aim to achieve this through partnerships with cutting-edge solution providers, inventive engagement models, exhaustive automation, and modernistic technologies with exemplary characteristics.

These capital market software firms are critical in guaranteeing that their services and technologies are in step with the industry’s new wave of digitization. They allowed firms to adjust to the “new normal” and stay profitable in a challenging market even throughout the outbreak.

Several capital market experts felt it necessary to learn about their business, issues, and strategic goals throughout the pandemic. They assisted their clients in developing unique solutions and maximizing chances for competitive advantage.

In addition, consumers could choose the correct balance of services because of their comprehensive approach. This allowed them to concentrate on their primary business.

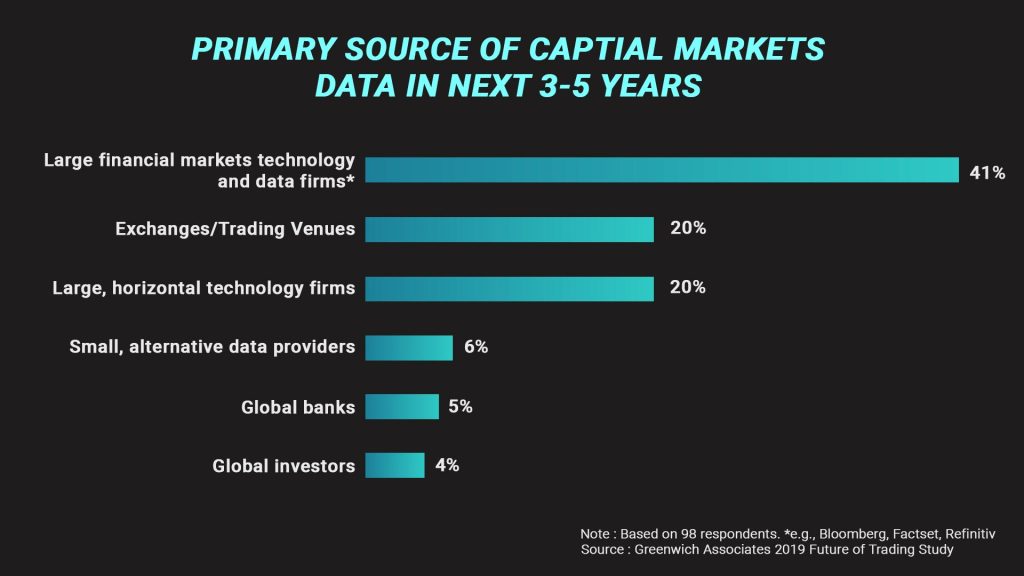

The above graph represents the primary source of capital markets data for the next 3-5 years. About 41% occupy the large financial markets; 20% occupy the exchanges/trading values; 20% occupy the large, horizontal technology firms; 6% occupy small alternate data providers; 5% occupy global banks; 4% occupy the global investors.

As the world recovers from the ravages of the virus, technology is assisting corporations in reviving their businesses in the wake of so much unpredictability. From AI to digital media to big data to RPA, technology is becoming a key driver in this industry.

Spanning transition management, foreign exchange, institutional brokerage, and securities finance, capital market solution providers enable enterprises to benefit from fair trading, efficient liquidity strategies, modern technology, and excellent execution.

However, today, providers must make substantial investments in their financial market’s competence and innovation. This will help their clients take advantage of the most up-to-date options for improving their portfolio returns.

A credentialed capital market model can fulfill objectives and apply them to a specific activity even in the face of intense competition. As a result, most solution providers will benefit from utilizing promising technological advancements.

The leading solution providers must seek to increase public trust in capital market solutions. If they cannot do so, the consequences of technology misuse will be disastrous.

Furthermore, capital market solution providers must improve their skills to reduce fraudulent use, leading to data breaches. This will ensure that only the positive capabilities of technology are harnessed!

- Capital Market Solution Providers

- All Categories

- Capital Market Solution Providers

- All Years

- All Years

- 2018

- 2019

- 2020

- 2021

- 2022